3 Best Fertilizer Stocks To Buy in 2022

Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. Yes, there are several ETFs available that provide https://1investing.in/ exposure to the fertilizer industry, such as the VanEck Vectors Agribusiness ETF and iShares MSCI Global Agriculture Producers ETF. These ETFs invest in companies producing fertilizers, agricultural chemicals, seeds and farm machinery.

CF released its earnings for 2022’s fourth quarter and full year, reporting record financial performance for both periods. Net earnings nearly quadrupled despite a slight decrease in the volume of products sold. The one-year price target is $103.17, which is about 42% above the current price. Perhaps most impressively, they target a price of $65, above 48% from its end-of-2022 price.

Mosaic Co. stock falls Wednesday, underperforms market

Some investors are comfortable with taking on higher levels of risk in the pursuit of higher returns, while others may prefer a more conservative approach to their investments. While we are independent, we may receive compensation from our partners for featured placement of their products or services. Disclaimer – We endeavour to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide.

- Full-year revenues were $12.4 billion, a 42 percent increase from the previous year.

- Demand for IPI’s goods is predicted to climb as global potash inventories fall.

- By understanding these investment options, investors can make informed decisions about gaining exposure to the fertilizer industry and benefiting from its growth potential.

- Crop nutrients are essential to drive agricultural productivity and boost the natural fertility of the soil.

- By determining investment objectives, investors can create a roadmap for their investments, helping them to stay focused and make more informed investment decisions.

If you want to see more stocks in this selection, check out 5 Best Fertilizer Stocks to Buy According to Hedge Funds. The overall spike in gas prices in early 2022 resulted in higher costs for the essential ingredients needed for fertilizer production. In Europe, gas represents 90% of the variable costs involved in fertilizer production. While the U.S. is not immune to these spikes, Europe was hit particularly hard due to the conflict between Russia and Ukraine. The company, which is headquartered in California, operates a number of businesses in the U.S., Australia, Brazil, Mexico and elsewhere. American Vanguard is the smallest company on this list by market cap, but the stock showed outstanding performance in 2022 and is still on the rise in early 2023.

Disney Stock Outlook: Is DIS Doomed or Time to Buy the Dip?

Scotts Miracle-Gro Company is listed on the NYSE, has a trailing 12-month revenue of around USD3.7 billion and employs 6,100 staff. Of course, with such strong performances, there are two ways to assess the underlying investment. On the pessimistic side, it’s possible that AVD could be due for a correction. After all, fears of a global recession dominated last year’s business headlines. Still, on the optimistic front, AVD could carry momentum into this year and perhaps beyond. When investing in fertilizer, selecting the right investment vehicle is critical to achieving one’s objectives.

The fertilizer industry is not closely correlated with other sectors of the economy, providing a level of insulation from broader market fluctuations. Accelerating demand for natural and organic farming and crop rotation is expected to drive the need for these fertilizers. Local Bounti, a Montana-based ag tech start-up, also has big ambitions, targeting $462 million in revenue by 2025 as it plans to open four new facilities.

Company Descriptions

Another strategy is to invest in companies developing new technologies or products related to fertilizers. For example, some companies are exploring using drones, artificial intelligence and precision agriculture to improve fertilizer application and reduce waste. Investing in these companies can provide exposure to the potential benefits of innovation in the fertilizer industry. The highly diverse agriculture industry encompasses many sub-sectors, including crop production, livestock farming, forestry and fisheries. It employs millions worldwide, from small family farms to large agribusiness corporations.

We round up a selection of stocks in or related to the plant food industry, weighting the list more heavily towards popular mid- and large-cap US stocks. At the moment, Gurufocus.com notes that Mosaic features eight positive signs with no yellow or red flags. Typically, even industry leaders will carry some weakness or vulnerability. Fundamentally, MOS attracts bullish investors for its cheap valuation, passive income trek, and stability in the balance sheet. By determining investment objectives, investors can create a roadmap for their investments, helping them to stay focused and make more informed investment decisions. Investors have many opportunities to get involved in this industry, from traditional stock investments to more exotic investment types.

Overview of the Agriculture Industry

Using fertilizers in agriculture has been critical in boosting crop yields and increasing food production. However, excessive use of fertilizers can also have negative environmental impacts, such as soil degradation, water pollution and greenhouse gas emissions. Governments play a significant role in regulating and supporting the agriculture industry. Many countries provide subsidies and other incentives to farmers to encourage production while regulating the use of pesticides, fertilizers and other inputs to protect the environment and ensure food safety. The adoption of precision agriculture techniques, such as sensors, drones and satellite imagery, is expected to increase the efficiency and effectiveness of fertilizer usage. The trend should further drive demand for fertilizers as farmers optimize crop yields.

Its economies of scale and vertical integration give it a competitive advantage in agriculture, and investors should expect steady growth as global demand for food and biofuels continues to grow. The scale required for operations has led to market power being concentrated in a handful of titans. These companies — many with healthy profits, cash flows, and dividends — offer excellent opportunities for investors. Fertilizer stocks are a good investment as they’re necessary for food production. What is certain is that there will always be some event that puts pressure on crop production and results in high stock prices for fertilizer once again. The factors mentioned above, such as supply chain issues, reduction in exports, the Ukraine-Russia conflict and demand, will be around for a while.

Finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Owning a stock means you own part of a company and can potentially grow your wealth.

FMC Corp. (FMC)

Rallying crop commodity prices and solid farmer economics are spurring demand for major fertilizers such as potash, phosphate and nitrogen. Strong global demand coupled with supply constraints has boosted crop commodity prices. Higher freight, energy and labor costs and raw material shortages have contributed to the upside. Higher agricultural commodity prices augur well for crop nutrient demand in 2022.Strong farmer profit margins driven by an upswing in crop commodity prices are also likely to boost fertilizer demand this year. Grower economics remain attractive in most global growing regions on strong crop demand. In the United States, healthy farm profits and high levels of planted acreage are expected to drive demand for fertilizers.

- Another strategy is to invest in companies developing new technologies or products related to fertilizers.

- Vantage Market Research expects the global fertilizer market to reach $219.4 billion by 2028 and is forecasted to exhibit a compound annual growth rate of 2.3% during the forecast period.

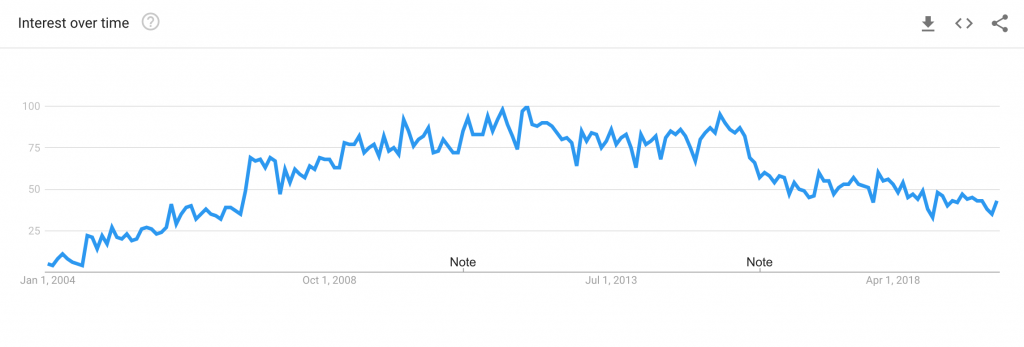

- The fertilizer industry has had a solid run in 2021, thanks to strong global demand and prices of crop nutrients.

On a notable upward trend since Q4 of 2021, CF has a YTD price increase of +40%, and over one year is up +100%. Currently, the stock is trading just under $100/share with stellar momentum. With A’s over the last four quarters and six-month price performance relative to its sector peers that’s unheard of, as evidenced below, it’s no wonder this stock is a strong buy. Now, the challenge for prospective investors of CTVA is whether to pursue the stock’s momentum.

Investing in Agriculture Stocks

The momentum is expected to continue, backed by strong demand and pricing fundamentals for crop nutrients.As such, stocks with compelling prospects like Nutrien Ltd. NTR, The Mosaic Company MOS, Sociedad Quimica y Minera de Chile S.A. SQM, CF Industries Holdings, Inc. The Zacks Fertilizers industry is enjoying a solid run, thanks to strong global demand and surging prices of crop nutrients. The underlying strength of the agricultural market, a rally in crop commodity prices and attractive farm economics are driving demand for fertilizers globally.

BlackBerry leads TSX to third straight day of losses – Reuters

BlackBerry leads TSX to third straight day of losses.

Posted: Thu, 07 Sep 2023 20:53:00 GMT [source]

This increase will naturally mean fertilizer stocks will move higher as they can increase profits. If you have been paying attention to the news recently, you have heard about the shortage of fertilizer needed to grow crops. This shortage results from various events, including difference between oem and odm the pandemic, high gas prices and the Russia-Ukraine conflict. While the company is not yet profitable, analysts are bullish on the stock, rating it a “strong buy” and setting an average 12-month price target of $27.88, which is 140% higher than the current price.